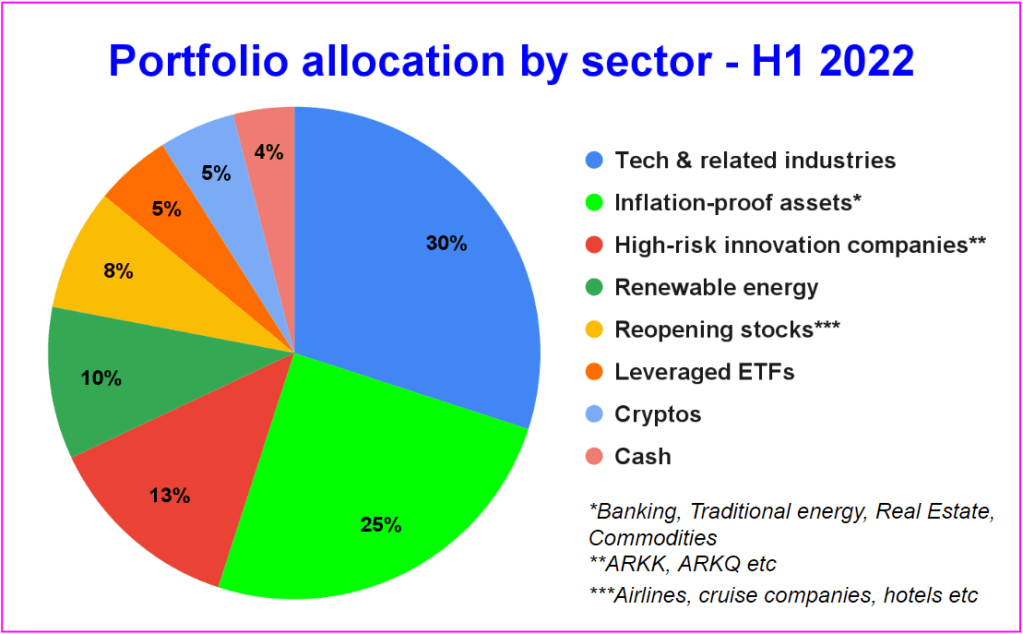

Allocation by sector – Strategy for 2022

I invest in different sectors to create a balanced portfolio that will grow well, along with the market and despite the economic challenges.

Studying macroeconomics is crucial to understand where to invest.

In 2022, I expect tech companies and the related industries like semiconductors to continue to overperform, as the usage of tech products continues to grow exponentially. Moreover, consumer usage of technology is not really threatened by challenges like the Ukraine conflict and its economic consequences, as well as inflation.

However, inflation is definitely going to impact the global economy, which is why the second biggest sector in my portfolio is composed of inflation-proof assets, that should overperform in such an environment. You can find more details about inflation in 2022 in this article.

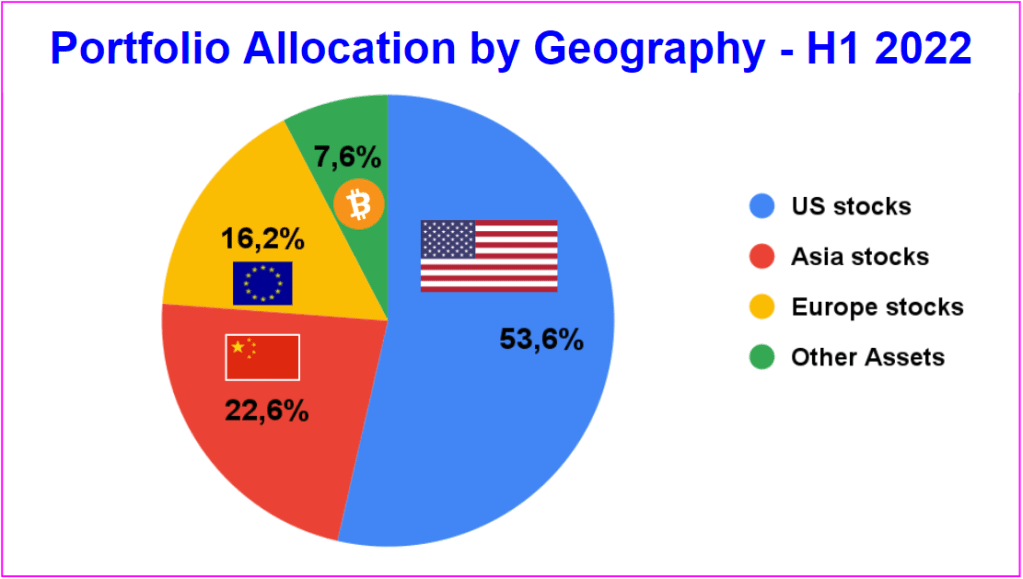

Allocation by geography – Strategy for 2022

Investing in different geographies is a key requirement for a balanced portfolio. This diversification will bring strength as well as resilience, as most of the times, different regions in the world are affected differently by macroeconomic events.

For instance, the Ukraine conflict is affecting more Europe than other regions, while Covid in 2022 is currently hurting mostly China’s economy, while inflation has more important consequences over the US economy.

Similarly, every region has its strengths: the US are still leading the world’s economy, but US stocks are very expensive (financial results vs price per share etc). At the same time, many companies in Europe and China have a lot of room for growth in terms of revenue and market capitalization.

The portfolio’s allocation reflects the advantages and risks of each region, with priority given to the US stocks, given the leading position of the US economy as well as its resilience.