Article written in April 2022

🎯 Why should you consider investing in the semiconductor industry?

💡 1. Definition and context:

Semiconductors, or chips, are industrial products used in many products of our daily lives: computers, phones, cars, washing machines etc.

Players in the industry can focus on engineering and designing these products, like Nvidia Corporation or AMD, or solely manufacturing them, like TSMC, or both, like Intel.

There are several ETFs on eToro that let us invest in this industry, with the most famous being SOXX and SMH.

I personally also like to invest in the leveraged ETF SOXL that reproduces x3 the daily performance of SOXX.

Let’s see what kind of investment opportunity it is.

💡 2. Challenges ahead:

It’s no secret that the semiconductor supply chain has been encountering great issues since Covid started, because of different challenges at a manpower level (factories shitting down temporarily etc), as well as logistics (maritime transport disruptions, import/export rules), and supply of raw materials.

While these points are actually likely to see drastic improvements in 2022, the greater risk for the semiconductor industry is actually a geopolitical risk.

Semiconductors, chips and their innovations are so important for our near future that governments are watching closely the companies involved in the sector, and could decide to take actions that may disrupt further the industry.

For instance, TSM (Taiwan Semiconductor Manufacturing Co Ltd) is one of the most important players in the industry, and it’s located in an area subject to territorial disputes. Any conflict between Taiwan and China would pose a serious threat to the stability of the semiconductor market.

💡 3. Opportunities:

That being said, despite the possible obstacles on the way, the semiconductor industry is going to experience a phenomenal expansion in the next years.

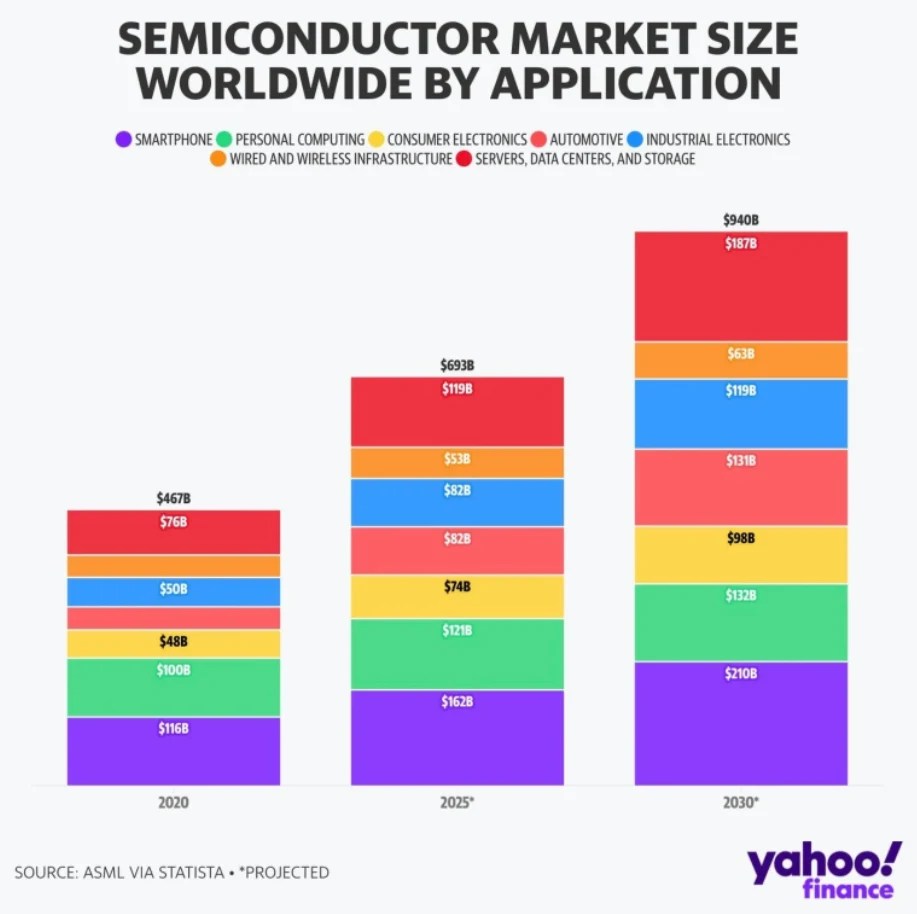

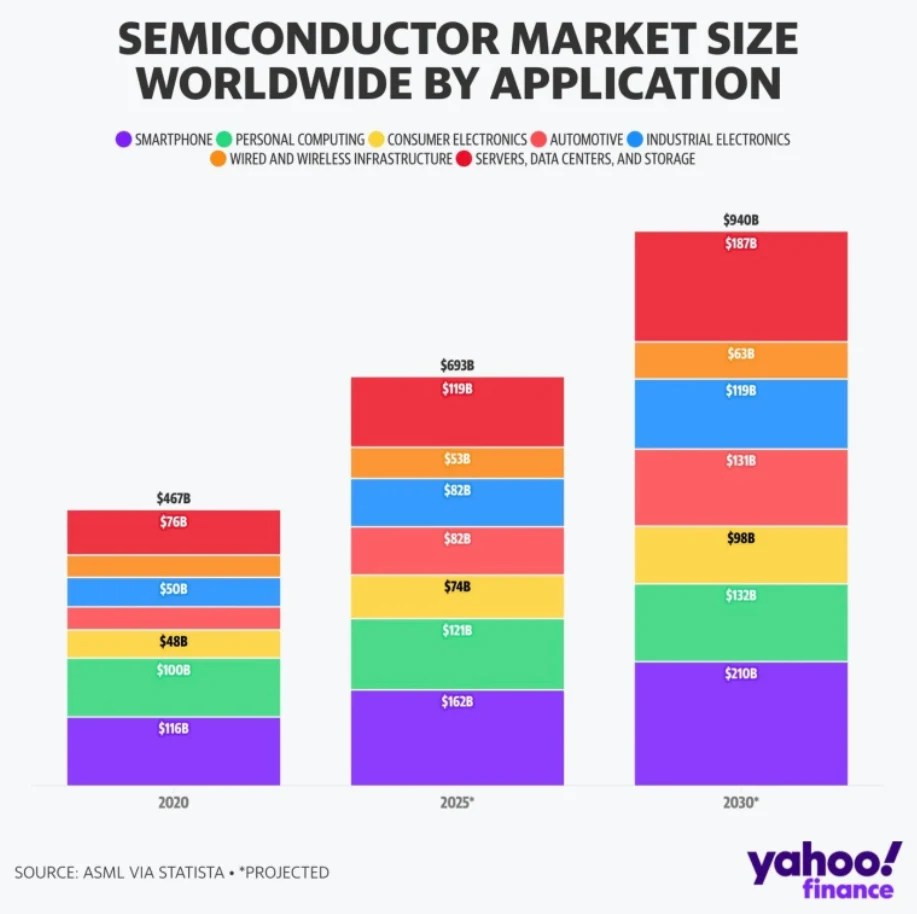

Indeed, semiconductors are components of the items we use the most, and that we increasingly rely on: smartphones, computers, servers and data centers etc.

Thus, the semiconductor market is expected to double in size from 2020 to 2030 (see chart enclosed).

Furthermore, some key companies in the ETFs mentioned above, like Nvidia, are likely to experience even more growth by taking part into related applications like the Metaverse (see the Fool.com article enclosed at the bottom).

💡 4. Conclusion:

If you take a long-term vision (years and not months), there is a great chance you will be rewarded by investing in the semiconductor industry, as the use our society makes of it will only increase. If you are not comfortable picking specific stocks, investing in related ETFs are the best way to start.

Thank you and trade safe!

Nico

Sources:

Investopedia

Fool.com