Article written in April 2022

🎯 Is investing in the stock market really profitable?

💡 Context:

I hear people saying that investing in the stock market is the best way to make money; at the same time, I also hear people saying that it’s like gambling, and the risk of losing part of, or even all your investment, is not worth trying.

Thus, let’s look at facts. For this article, I will talk about the SP500 index, as it is commonly used as benchmark to evaluate the performance of an investment portfolio.

The SP500 index (short for Standard & Poor’s 500 Index) is composed by 500 US-listed companies, and it has been this way since 1957. The companies in that index are chosen by the S&P 500 Index Committee, who select them based on market size, liquidity and group representation. This ensures that the SP500 index represents fairly well the US economy, and this is the reason why the index’s performance is commonly used to benchmark investment returns.

💡 SP500 historical returns:

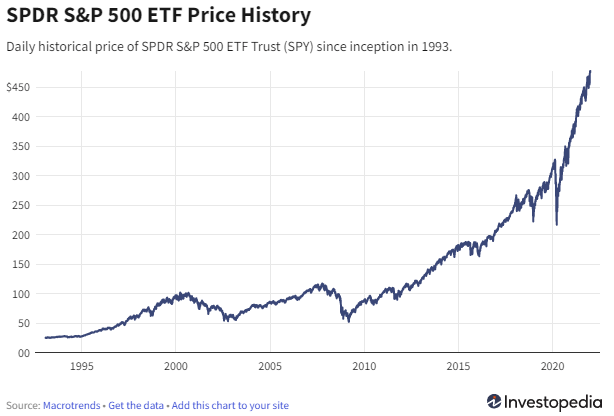

Since 1957, the average annual return of the SP500 index is 10.67%.

Since 1972 (50 years ago), it’s even higher: the average annual return is at 11.17%.

This means that if you had invested $10,000 in 1957 and got the same returns, your investment would now be worth more than $650 million.

Such a consistent performance means that yes, investing in the stock market is really profitable on the long term.

💡 To keep in mind:

The historical performance of the SP500 index is truly impressive.

However, only taking a long-term perspective, not even in years but in decades, enable to achieve such returns.

On a yearly basis, your return on investment may very well be negative (in case of an ecomonic crisis etc).

Actually, if you look at the SP500 annual return chart, you can see that most of the years actually have double digit returns – positive or negative. The journey is not smooth.

Thus, you should only invest money that you will not need in the near future (3 to 4 years from now).

Thank you and trade safe!

Nico

Source: Investopedia